26 February 2020 – This essay is a transcription of a paper I wrote last week as part of my studies for a Doctor of Business Administration (DBA) at Keiser University.

Developing a theory that quantitatively determines the rate of exchange between two fiat currencies has been a problem since the Song dynasty, when China’s Jurchen neighbors to the north figured out that they could emulate China’s Tang-dynasty innovation of printing fiat money on paper (Onge, 2017). With two currencies to exchange, some exchange rate was needed. This essay looks to Song-Dynasty economic history to find reasons why foreign exchange (forex) rates are so notoriously hard to predict. The analytical portion starts from the proposition that money itself is neutral (Patinkin & Steiger, 1989), and incorporates recently introduced ideas about money (de Soto, 2000; Masi, 2019), and concludes in favor of the interest rate approach for forex-rate prediction (Scott Hacker, Karlsson, & Månsson, 2012).

Song-Dynasty Economics

After the introduction of paper money, the Song Chinese quickly ran into the problem of inflation due to activities of rent seekers (Onge, 2017). Rent-seeking is an economics term that refers to attempts to garner income from non-productive activities, and has been around since at least the early days of agriculture (West, 2008). The Greek poet Hesiod complained about it in what has been called the first economics text, Works and Days, in which he said, “It is from work that men are rich in flocks and wealthy … if you work, it will readily come about that a workshy man will envy you as you become wealthy” (p. 46).

Repeated catastrophes arose for the Song Chinese after socialist economist Wang Anshi, prime minister from 1069 to 1076, taught officials that they could float government expenditures by simply cranking up their printing presses to flood the economy with fiat currency (Onge, 2017). Inflation exploded while productivity collapsed. The Jurchens took advantage of the situation by conquering the northern part of China’s empire. After they, too, destroyed their economy by succumbing to Wang’s bad advice, the Mongols came from the west to take over everything and confiscate the remaining wealth of the former Chinese Empire to fund their conquest of Eurasia.

Neutrality of Money

The proposition that money is neutral comes from a comment by John Stuart Mill, who, in 1871, wrote that “The relations of commodities to one another remain unaltered by money” (as cited in Patinkin & Steiger, 1989, p. 239). In other words, if a herdsman pays a farmer 50 cows as bride price for one of the farmer’s daughters, it makes no difference whether those 50 cows are worth 100 gold shekels, or 1,000, the wife is still worth 50 cows! One must always keep this proposition in mind when thinking about foreign exchange rates, and money in general. (Apologies for using a misogynistic example treating women as property, but we’re trying to drive home the difference between a thing and its monetary value.)

Another concept to keep in mind is Hernando de Soto’s (2000) epiphany that a house is just a shelter from the weather until it is secured by a property title. He envisioned that such things as titles inhabit what amounts to a separate universe parallel to the physical universe where the house resides. Borrowing a term from philosophy, one might call this a metaphysical universe made up of metadata that describes objects in the physical universe. de Soto’s idea was that existence of the property-title metadata turns the house into wealth that can become capital through the agency of beneficial ownership.

If one has beneficial ownership of a property title, one can encumber it by, for example, using it to secure a loan. One can then invest the funds derived from that loan into increased productive capacity of a business–back in the physical universe. Thus, the physical house is just an object, whereas the property title is capital (de Soto, 2000). It is the metaphysical capital that is transferable, not the physical property. In the transaction between the farmer and the herdsman above, what occurred was a swap between the two parties of de-Sotoan capital derived from beneficial ownership of the cattle and of the daughter, and it happened in the metaphysical universe.

What Is Money, Really?

Much of the confusion about forex rates arises from conflating capital and money. Masi (2019) speculated that money in circulation (e.g., M1) captures only half of what money really is. Borrowing concepts from both physics and double-entry bookkeeping, he equated money with a two-part conserved quantity he referred to as credit/debit. (Note that here the words “credit” and “debit” are not used strictly according to their bookkeeping definitions.) Credit arises in tandem with creation of an equal amount of debit. Thus, the net amount of money (equaling credit-minus-debit) is always the same: zero. A homeowner raising funds through a home-equity line of credit (HELOC) does not affect his or her total wealth. The transaction creates funds (credit) and debt (debit) in equal amounts. Similarly, a government putting money into circulation, whether by printing pieces of paper, or by making entries in a digital ledger, automatically increases the national debt.

Capital, on the other hand, arises, as de Soto (2000) explained, as metadata associated with property. The confusion comes from the fact that both capital and money are necessarily measured in the same units. While capital can increase through, say, building a house, or it can decrease by, for example, burning a house down, the amount of money (as credit/debit) can never change. It’s always a net zero.

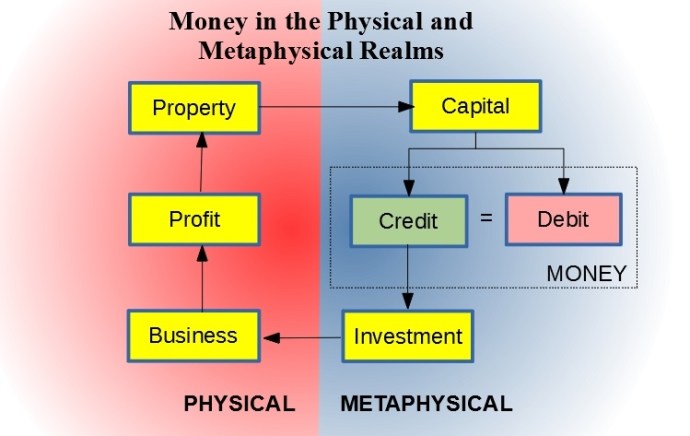

The figure above shows how de Soto’s (2000) and Masi’s (2019) ideas combine. The cycle begins on the physical side with beneficial ownership of some property. On the metaphysical side, that beneficial ownership is represented by capital (i.e., property title). That capital can be used to secure a loan, which creates credit and debit in equal amounts. The beneficial owner is then free to invest the credit in beneficial ownership of a productive business back on the physical side. The business generates profits (e.g., inventory) that the owner retains as an increase in property.

The debit that was created along the way stays on the metaphysical side as an encumbrance on the total capital. The system is limited by the quantity of capital that can be encumbered, which limits the credit that can be created to fund continuing operations. The system grows through productivity of the business, which increases the property that can be represented by new capital, which can be encumbered by additional credit/debit creation, which can then fund more investment, and so forth. Note that the figure ignores, for simplicity, ongoing investment required to maintain the productive assets, and interest payments to service the debt.

Wang’s mismanagement strategy amounted to deficit spending–using a printing press to create credit/debit faster than the economy can generate profit to be turned into an increasing stock of capital (Onge, 2017). Eventually, the debt level rises to encumber the entire capital supply, at which point no new credit/debit can be created. Continued running of Wang’s printing press merely creates more fiat money to chase the same amount of goods: inflation. Thus, inflation arises from having the ratio of money creation divided by capital creation greater than one.

In Song China, investment collapsed due to emphasis on rent seeking, followed by collapsing productivity (Onge, 2017). Hyperinflation set in as the government cranked the printing presses just to cover national-debt service. Finally, hungry outsiders, seeing the situation, swooped in to seize the remaining productive assets. First it was the Jurchens, then the Mongols.

Forex and Hyperinflation

The Song Chinese quickly saw Wang’s mismanagement at work, and kicked him out of office (Onge, 2017). They, however, failed to correct the practices he’d introduced. Onge (2017) pointed out that China’s GDP per person at the start of the Song dynasty was greater than that of 21st-century Great Britain. Under Wang’s policies, decline set in around 1070–80, and GDP per person had fallen by 23% by 1120. Population growth changed to decline. Productivity cratered. Inflation turned to hyperinflation. The Jurchen, without the burden of Wang’s teachings, were slower to inflate their currency.

As Chinese inflation increased relative to that of the Jurchen, exchange rates between Jurchen and Chinese currencies changed rapidly. The Jurchen fiat currency became stronger relative to that of the Chinese. This tale illustrates how changes in forex rates follow relative inflation between currencies, and argues for using the interest rate approach to predict future equilibrium forex rates (Scott Hacker, et al., 2012).

Conclusion

Forex rates are free to fluctuate because money is neutral (Patinkin & Steiger, 1989). Viewing money as a conserved two-fluid metaphysical quantity (Masi, 2019) shows how a country’s supply of de-Sotoan capital constrains the money supply, and shows how an economy grows through profits from productive businesses (de Soto, 2000). It also explains inflation as an attempt to increase the money supply faster than the capital supply can grow. The mismatch of relative inflation affects equilibrium forex rates by increasing strength of one currency relative to another, and argues for the interest-rate approach to forex theory (Scott Hacker, et al., 2012).

References

de Soto, H. (2000). The mystery of capital. New York, NY: Basic Books.

Masi, C. G. (2019, June 19). The Fluidity of Money. [Web log post]. Retrieved from http://cgmblog.com/2019/06/19/the-fluidity-of-money/

Onge, P. S. T. (2017). How paper money led to the Mongol conquest: Money and the collapse of Song China. The Independent Review, 22(2), 223-243.

Patinkin, D., & Steiger, O. (1989). In search of the “veil of money” and the “neutrality of money”: A note on the origin of terms. Scandinavian Journal of Economics, 91(1), 131.

Scott Hacker, R., Karlsson, H. K., & Månsson, K. (2012). The relationship between exchange rates and interest rate differentials: A wavelet approach. World Economy, 35(9), 1162–1185.

West, M. L. [Ed.] (2008). Hesiod: Theogony and works and days. Oxford, UK; Oxford University Press.